Editor’s Brief

Last Week, Last week we looked at Hermeus and their mission of “Delivering capabilities that ensure our nation and allies maintain an asymmetric advantage over any and all potential adversaries.”

This week, we’re headed across the Atlantic and looking at the Anduril of Europe: Helsing.

As always, your feedback shapes our coverage—reply directly with insights or questions.

All Images Credited to Helsing

Signal Brief: Helsing — Europe’s Answer to Anduril

Helsing is a fast-growing European defense technology startup specializing in artificial intelligence (AI) and autonomous systems for military applications. It has aligned its products with NATO/EU modernization priorities, securing high-profile contracts such as building the AI backbone for Europe’s Future Combat Air System (FCAS) program and supplying thousands of AI-guided drones to Ukraine.

Origins & Vision

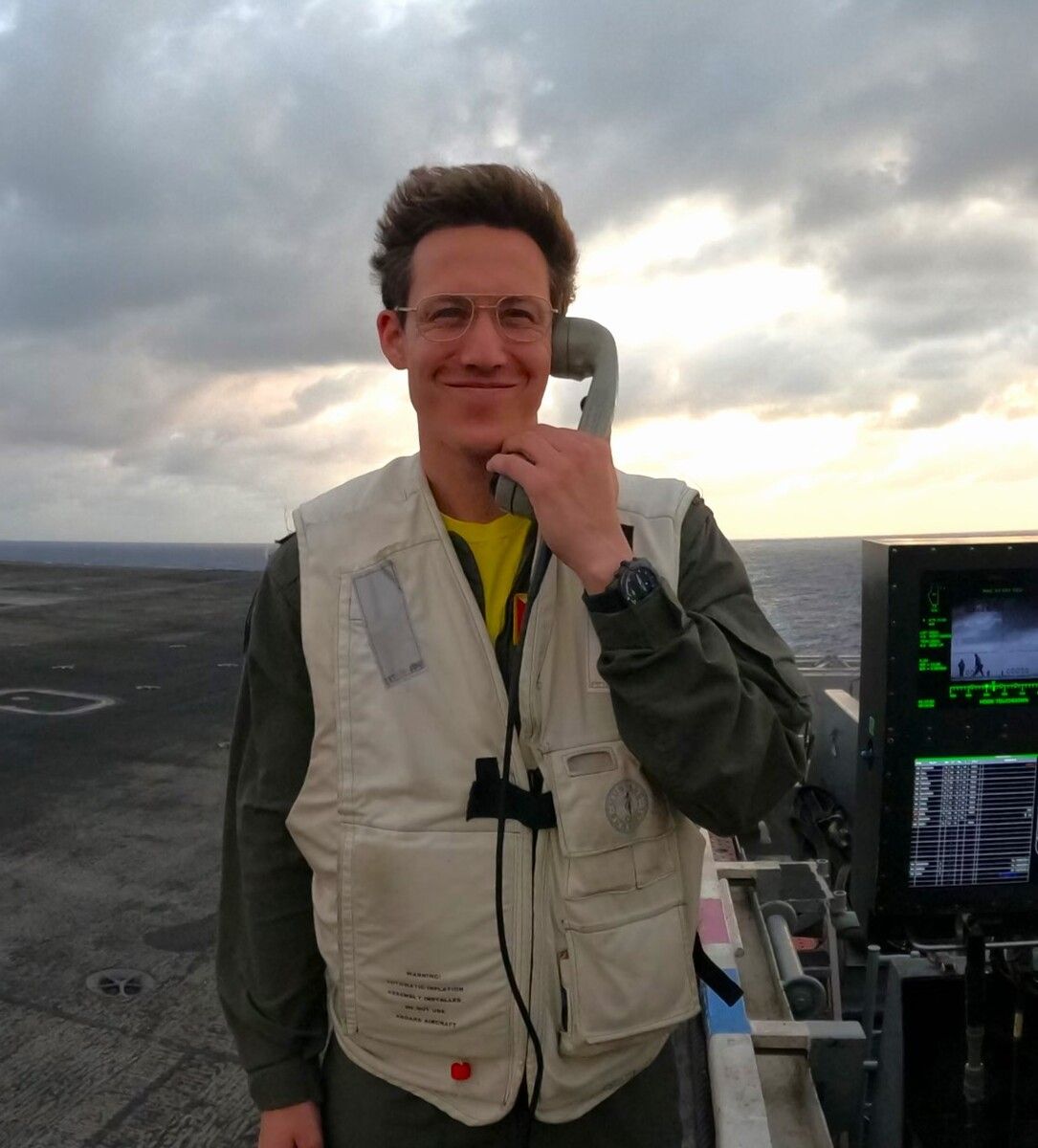

Founded in 2021 by Torsten Reil, Dr. Gundbert Scherf, and Niklas Köhler, Helsing was started to apply cutting-edge AI to the defense of European democracies. The founders’ conviction was shaped by events such as Russia’s 2014 annexation of Crimea, which exposed Europe’s dependence on aging military systems.

Early efforts centered on AI software that could fuse and analyze data from sensors, drones, and weapons systems in real time to help commanders build a precise live map of the battlespace and make faster, better-informed decisions.

Recognizing that software alone wasn’t enough, Helsing expanded into AI-enabled hardware, unveiling the HX-2 strike drone in late 2024. By mid-2025, the company was developing autonomous systems across air, sea, and space, tightly integrated with its AI suite.

Helsing is unapologetic about their mission:

We founded Helsing to help protect our democratic values and open societies. The freedom to say what we want to say, and to be who we want to be, is a privilege and it cannot be taken for granted. We believe it is our civic duty to preserve this freedom for us and future generations.

Key Takeaways

Sovereignty as Strategy – European ownership through Daniel Ek’s Prima Materia and a democracies-only sales policy make Helsing the trusted AI partner for sensitive sovereign programs like FCAS.

Vertical Integration Imperative – Resilience Factories in Germany and the UK give Helsing end-to-end control, from AI algorithms to autonomous platforms.

Strategic Partnerships – Collaborations with Saab (Eurofighter EW) and Systematic (SitaWare C4ISR) extend reach while preserving IP control.

Combat Validation – Active deployment in Ukraine provides operational data dramatically shortening product-improvement cycles.

Tech Radar:

Altra – Battlefield Management Platform

Fuses data from drones, radars, and soldier-borne sensors into a single operational picture. Integration with Systematic’s SitaWare (used by 50 + allied nations) accelerates adoption by embedding Helsing AI into existing command networks.

Cirra – Electronic Warfare AI

Co-developed with Saab and embedded in Germany’s Eurofighter EK; analyzes radar emissions in real time to identify and counter threats.

CA-1 Europa

Centaur – Autonomous Air Combat

Centaur is the brain behind the upcoming CA-1 Europa, an autonomous fighter jet slated for 2027 flight tests and 2029 service entry. Earlier this year, the Centaur AI pilot flew a Saab Gripen E during a beyond-visual-range mock dogfight over the Baltic.

SG-1 + Lura

Lura – Maritime Acoustic AI

Employs a “large acoustic model” to detect submarines and monitor undersea infrastructure. The 2025 acquisition of Blue Ocean added the SG-1 for silent, long-endurance undersea surveillance.

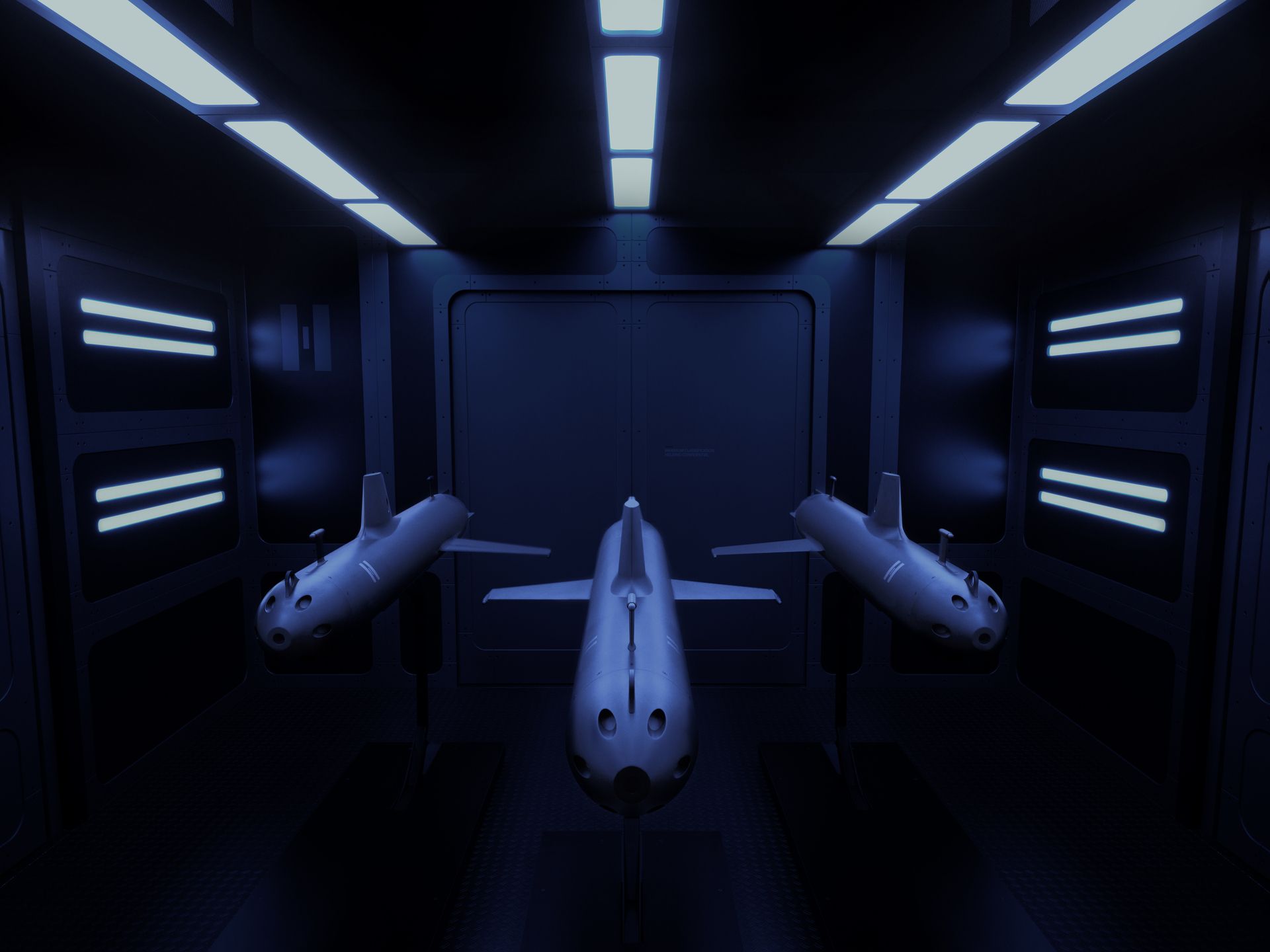

HX-2 Drone

Loitering munition with 100 km range, 250 km/h cruise speed, and 5 kg payload; operates without GPS. Ukraine ordered 10,000 units from Helsing’s southern Germany factory, now scaling to wartime production capacity in the tens of thousands.

Market Signals

Funding & Growth

Total Funding: €1.4billion ($1.63 billion) across eight rounds

Latest Round: €600 million Series D (June 2025)

Notable Investors: Prima Materia (Spotify’s Daniel Ek), General Catalyst, Accel, Lightspeed Venture Partners, Saab Ventures

Valuation: €12 billion ($13.8 billion)

Contracts & Government Traction

Eurofighter EK Upgrade (Germany): Joint Helsing–Saab Cirra integration; part of €1.13 B program.

Future Combat Air System (Germany–France–Spain): Leading AI infrastructure developer within the HIS consortium (Helsing, IBM Deutschland, Rohde & Schwarz).

Ukraine Drone Supply: Two contracts totaling 10,000 HX-2 units; production ongoing.

Estonia Baltic Defense Partnership: €70 M program developing AI-powered reconnaissance and strike systems on NATO’s eastern flank.

Partnerships & Acquisitions

Partnerships: ARX Robotics (ground systems), Systematic (C4ISR), Saab (EW), Ocean Infinity (maritime autonomy), QinetiQ (data integration), Mistral AI (LLMs).

Acquisitions: Grob Aircraft SE (aerospace manufacturing) and Blue Ocean (autonomous underwater vehicles).

Looking Ahead

Europe’s defense landscape remains run by a few major players much like the U.S. defense industry. A hardware-heavy bloc built on long production cycles and 8–10 % gross margins that have existed in one form or another for decades.

Helsing is pursuing a different path: software-first defense with front-loaded R&D and recurring AI upgrades that replace hardware retrofits.

Anduril is validating this model in the U.S. market, maintaining 40-45% gross margins while reaching $1 billion in revenue in 2024. Their acquisition-heavy strategy (Area-I, Dive Technologies, Blue Force Technologies, Klas) opens up new verticals yearly and continues to grow their pie.

Helsing is executing the same playbook with European characteristics: acquire niche specialists, embed AI into programs of record, and build manufacturing resilience for autonomous mass production.

The FCAS AI backbone and Eurofighter EW integration position them to collect recurring software revenue across decades of European air combat operations.

Yet, much like Anduril, success hinges on their next milestone: the CA-1 Europa autonomous fighter.

If Helsing proves AI systems can perform reliably in contested electromagnetic environments, they may create an entirely new class of European defense prime.

If they miss, they’ll demonstrate that defense-industry economics still outweigh venture capital ambition.

Challenges

Manufacturing Scale Risk – Mastering complex supply chains and quality control at volumes the company has limited experience managing.

Multi-National Procurement Complexity – Europe presents 28 separate defense procurement systems with varying requirements

American Competition – Anduril's $1 billion in 2024 revenue and proven track record could allow it to underprice Helsing in European markets

Bottom Line:

Traditional primes didn't choose to become slow. They optimized for the incentive structures defense procurement created: cost-plus contracts reward process compliance over speed. Low margins demand volume over innovation. Multi-decade programs favor stability over agility.

Helsing is betting they can build different organizations optimized for different economics and still provide a consistent and repeated product line.

Stay Ahead of Defense Innovation

Not just because it’s content

But because the future is being built. And you want a seat at the table.