Editor’s Brief

Last Week we looked at Silkline AI, an AI-native supply chain orchestration platform built to compress Request-For-Quote (RFQ) to Purchase Order (PO) cycles in high-mix, low-volume manufacturing environments.

This week: Over the past year, Defense Tech Signals tracked dozens of defense companies across venture, credit, and procurement pathways.

This issue brings together our 2025 Coverage Map, financing survey results, perspectives from Leonid Capital Partners, and a forward look at the transition from innovation to reliability in 2026.

As always, your feedback shapes our coverage. Reply directly with insights or questions.

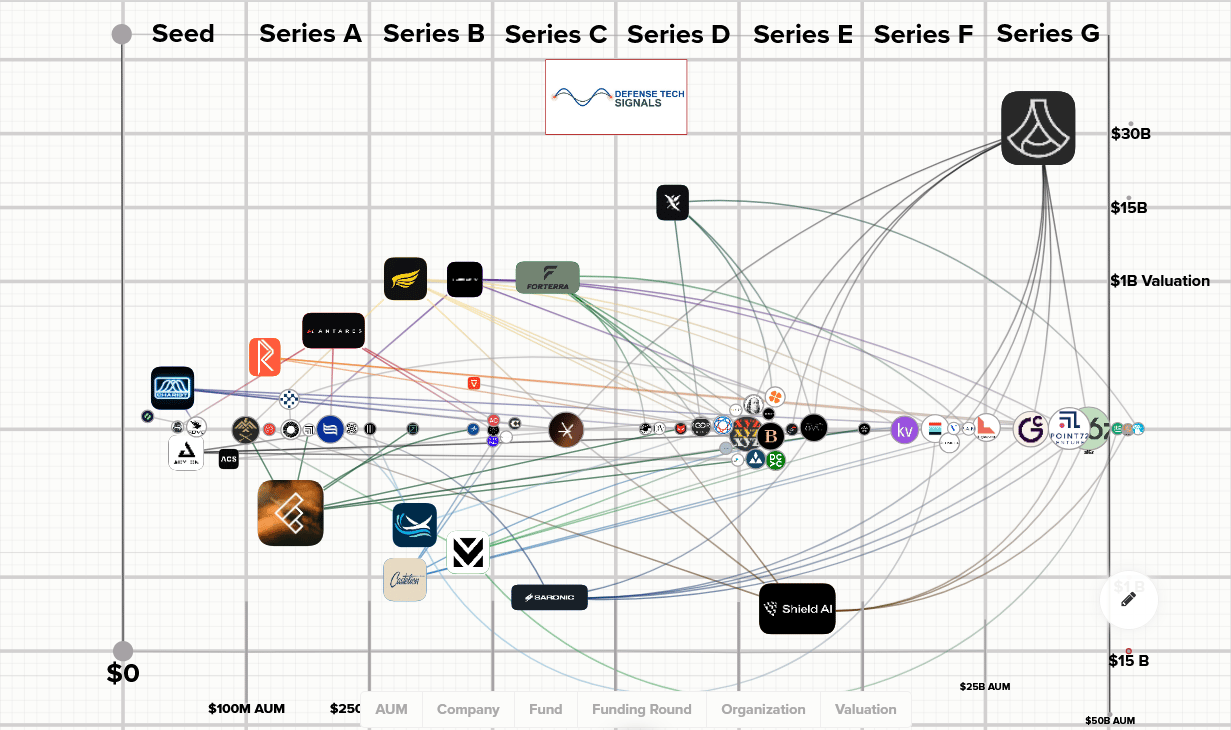

The DTS 2025 Coverage Map

The map is designed to provide orientation on where capital, demand, and execution pressure intersect as defense tech moves from experimentation toward delivery.

Signal Brief: Valuations are Loud

Defense tech headlines in 2025 were dominated by valuations. Mega-rounds became the default raise while unicorns multiplied.

But valuation reflects belief. Obligations reflect commitment.

Our team looked beyond fundraising announcements and into federal obligations data for every company covered in the newsletter in 2025.

Obligations are an imperfect measure: they lag early R&D, under count classified work, and skew toward services-heavy models. But they remain a closer proxy for delivered credibility, execution pressure, and near-term responsibility than valuation headlines alone.

Below is a snapshot of select defense unicorns covered in Defense Tech Signals.

Company | Valuation | Most Recent Round | Most Recent Amount | Total Funding | Total Obligations |

|---|---|---|---|---|---|

Anduril | $30.5B | June ‘25 | $2.5B | $ 6.2B | $ 4.37B |

Shield AI | $5.3B | Mar ‘25 | $240M | $ 1.3B | $ 231.8M |

Chaos | $4.5B | Nov ‘25 | $510M | $ 1B | $ 3.0M |

Saronic | $4.0B | Feb ‘25 | $600M | $ 845M | $ 239.2M |

Vannevar Labs | $1.5B | Jan ‘23 | $75M | $ 87M | $ 127.8M |

Epirus | $1.35B | Mar ‘25 | $250M | $ 537M | $ 136.8M |

Castelion | $1.0B+ | Dec ‘25 | $350M | $ 469M | $ 39.6M |

Forterra | $1.0B | Nov ‘25 | $238M | $ 649M | $170.8M |

Anduril, unsurprisingly, carries the largest absolute obligation base, with federal commitments equal to roughly 70 percent of total capital raised.

Shield AI, Saronic, Epirus, and Forterra show obligation growth that broadly tracks maturity.

Vannevar Labs stands apart entirely. It was the only unicorn covered in Defense Tech Signals that did not raise a round in 2025. At the same time, its total obligations far exceed its total equity funding (146.9% of capital raised). Vannevar operates closer to a services-enabled intelligence platform than a pure venture-scale product company.

Chaos Industries, by contrast, has raised significant capital while obligations remain minimal.

Low obligations are not proof of failure. High obligations are not proof of success.

What matters is obligation density: how much awarded demand exists per dollar of capital raised and how quickly that demand translates into execution strain.

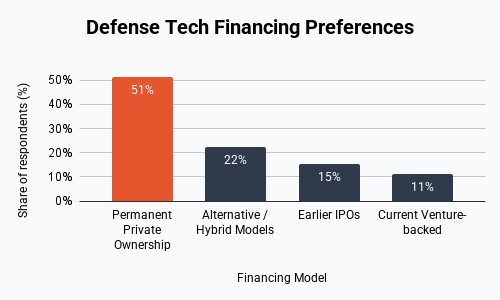

Should We Rethink the Venture Model for Defense Tech

Across two issues of Defense Tech Signals and on LinkedIn, we ran a poll on alternative financing models for defense companies.

Survey of DTS readers and LinkedIn respondents (n = 72)

A majority favored permanent private ownership, citing incentives that resemble industrial firms more than venture-backed startups: reinvesting profits, avoiding LP-driven timelines, and prioritizing durability over quarterly growth optics.

One respondent with deep public-markets experience offered a clear counterpoint to earlier IPO:

Going public earlier allows access to liquid capital and control over your destiny outside what your VC or biggest investors think.

Public markets allow more time to succeed and the ability to make bets without the risk that you can never go public if they fail.

VC has created perverse incentives to grow at all costs rather than compound over long periods.

The takeaway isn’t anti-venture. Venture capital has been effective at catalyzing innovation in many industries.

But just because that’s the way we’ve always done something doesn’t mean that’s necessarily the only way to continue doing it.

Structuring Capital Around Awarded Demand

Defense capital markets expanded rapidly in 2025, but growth exposed structural limits.

As programs moved from development into production and delivery, financing options narrowed. That constraint is now shaping how capital is structured across the defense ecosystem.

The following reflects Leonid Capital Partners’ perspective based on active deployment across venture, credit, and acquisition finance.

Contract-Aligned Capital Perspective

Capital deployment into defense and aerospace reached record levels in 2025, with global startup funding surpassing $19B. Private equity expanded aggressively into aerospace, defense, and government services, targeting platforms with durable contracts and recurring revenue. Transactions like Apollo’s $3.6B acquisition of Barnes Group reinforced confidence in long-duration defense cash flows.

Yet industry research consistently points to the same constraint: a missing middle.

Structuring Capital Around Contracts

Leonid has deployed over $400M in mission-aligned growth capital across more than 80 defense-critical companies and Leonid-backed founders have secured more than $3B in incremental contract revenue

The model works because defense contracts generate predictable cash flows. Capital structured around awarded demand allows companies to scale without premature dilution or forced exits.

This approach is not universal. It depends on awarded contracts, disciplined customers, and companies mature enough to execute without venture-style burn. But where it fits, it addresses a real structural gap.

Portfolio examples illustrate the point. Skyways used Leonid Capital to expand production capacity and operational readiness while Ion Storage Systems used contract-aligned growth capital to support facility expansion, engineering scale-up, and the operational rigor required to serve defense and advanced industrial customers.

The Trusted Capital Advantage

As scrutiny around foreign ownership, security clearances, and FOCI risk intensifies, capital itself has become a strategic constraint. Many venture investors lack the clearances or visibility required to diligence classified programs, limiting their ability to support companies as they move deeper into sensitive mission areas.

Leonid is recognized as a Trusted Capital Provider within the U.S. defense ecosystem. This designation reflects credibility with government stakeholders and allows portfolio companies to preserve eligibility for sensitive programs, accelerate contracting velocity, and avoid capital sources that introduce regulatory friction.

Looking Ahead to 2026

We started 2025 calling for structural change in defense procurement and the industrial base. That change did arrive. But the mistake would be to conclude that the innovation phase worked and the system is now in the clear.

2026 cannot be another year of reform memos and mega-rounds untethered from execution. Whether progress continues will depend less on policy and more on capital discipline and execution tolerance inside both companies and the institutions funding them.

The conditions exist for at least one major defense tech IPO, with Anduril the clear frontrunner and potentially Shield AI following. At the same time, I would not be surprising to see sideways and down rounds as capital begins to price in execution risk.

M&A activity should continue, not because the market is healthy, but because some companies will fail to raise, fail to win contracts, or fail to bridge the gap between venture-backed experimentation and programmatic delivery.

The small UAS market is especially exposed. Expect consolidation there first.

That transition will be uncomfortable. Creative destruction is a certainty, and it’s necessary.

The companies that make it through the next 24 months will be the ones that operate like real defense contractors (or that are still insulated by an unusually long VC runway). In practical terms, that means proving:

Manufacturing consistency at scale

Security and clearance compliance across the workforce and the supply chain

Contract execution discipline

Operational integration into existing military systems

Finally, if proposed command restructures go through, we may see a genuine rebalancing of attention away from Europe and toward the Pacific. That shift will be subtle and unlikely to show up in press releases. Unless you’re close to the work, expect the public narrative to look unchanged.

Bottom Line:

Defense tech is entering the long tail of an 80/20 problem. The first phase of reform, funding, and demonstration moved quickly and visibly, with broad alignment across government, capital, and industry.

What remains is harder and far less forgiving: turning awarded demand into reliable, repeatable capability. That final stretch will consume far more time, capital, and institutional patience than everything that came before.