Editor’s Brief

Last week we looked at Adyton’s suite of secure mobile products that digitize and automate accountability, logistics, and scheduling.

This week: Forterra, autonomous vehicles for the edge.

Image credit: Forterra

SIGNAL BRIEF: Forterra - Building the Backbone of Mission Autonomy

Forterra is turning autonomous ground vehicles from science projects into fielded kit. Built for off-road, GPS-denied, DDIL environments, their stack now powers some of the DoD’s most important autonomy bets: ROGUE-Fires, GEARS, UxS, and emerging autonomous mission systems that move, sense, and communicate as one formation.

Origins & Vision

Robotics Research (now Forterra) was founded in 2002 by Alberto Lacaze, who spent two decades building autonomy for the U.S. government. Early milestones included autonomous mine-clearing and convoy operations in Afghanistan (2009), leader-follower logistics, autonomous transit buses, and off-road UGV experiments.

The big shift came in December 2021 when the company raised a $200M Series A. By 2024, it rebranded as Forterra and hired CEO Josh Araujo, a former Marine and longtime aerospace & defense investment banker, to convert years of R&D into scalable product.

Last week, the company announced the close of a $238M Series C and also recently acquired the mobile mesh network company goTenna.

Forterra’s approach has been consistent: build for the hardest operational environment first (GPS-denied, contested zones), then apply that capability to easier commercial settings like yards, mines, and distribution centers where reliability matters most.

Key Takeaways

“Enable the primes” reduces capital requirements. By partnering with Oshkosh Defense (ROGUE-Fires) and BAE Systems (AMPV autonomy), Forterra uses existing manufacturing capacity instead of building its own.

GPS-denied autonomy as a moat. Their multi-modal autonomy survives spoofing and jamming, critical for Indo-Pacific and other contested operations.

Dual-use approach hedges volatility. Commercial partnerships (e.g., Hiab) for load handling and logistics automation diversify revenue beyond defense appropriations.

Tech Radar:

image: Forterra

AutoDrive® — The Core

A vehicle- and payload-agnostic autonomy appliqué kit designed for unstructured terrain and GPS-denied environments.

Multi-modal sensor fusion (LiDAR, radar, EO/IR, cameras)

Leader-follower, intelligent platooning, retrotraverse, waypoint navigation

Ruggedized and NDAA-aligned

TerraLink — C2 For Real Fleets

The supervisory control layer:

Single pane for planning, tasking, and monitoring multi-vehicle formations

Built for low-bandwidth, intermittent comms at the edge

Interfaces across platforms via open architectures and modular profiles

Vektor — Data Fabric in DDIL

Software-defined comms layer

Bridges heterogeneous radios and waveforms

Enables cross-network data flow aligned with JADC2 concepts

image Forterra

goTenna — The Mesh Backbone

Forterra’s October 2025 acquisition integrates low-SWaP, low-signature mesh directly into its autonomy stack:

Enables autonomous formations to communicate without legacy infrastructure

Moves Forterra firmly into “autonomous mission systems”

Mission Modules & CHAOS Partnership

Forterra is now packaging autonomy + comms + payload:

Mission Modules: Plug-and-play payloads (sensors, effectors) integrated with AutoDrive-equipped platforms.

CHAOS x Forterra: VANQUISH radar + AutoDrive on SMET-class vehicles → mobile counter-UAS nodes

Market Signals

Funding & Growth

Total Funding: $541M+ across three rounds

Latest Round: $238M Series C (Nov 2025)

Notable Investors: Enlightenment Capital, Moore Strategic Ventures, XYZ Venture Capital, Hedosophia, Salesforce Ventures, Franklin Templeton, Balyasny Asset Management, RTX Ventures, 9 Yards and NightDragon

Valuation: $1B+

Contracts & Government Traction

$114.9M Fully Obligated OTA IDV (Mar 2025) – Robotic breaching systems with 100% of contract value obligated upfront.

USMC ROGUE-Fires (Production) - Partnership with Oshkosh Defense to deliver the first production contract for autonomous JLTV platforms carrying Naval Strike Missile launchers for expeditionary fires.

Ground Expeditionary Resupply System (GEARS) - Downselected with Carnegie Robotics for final prototyping phase of Army's autonomous logistics program.

UxS Autonomy Integration - $4.8 million contract to integrate autonomy onto Infantry Squad Vehicles

Looking Ahead

There’s a misconception in defense circles that when a prime wins a contract, that’s where the money goes and where the work stops. It’s human nature to want a single culprit (or five) for the state we’re in. But the reality is more complicated.

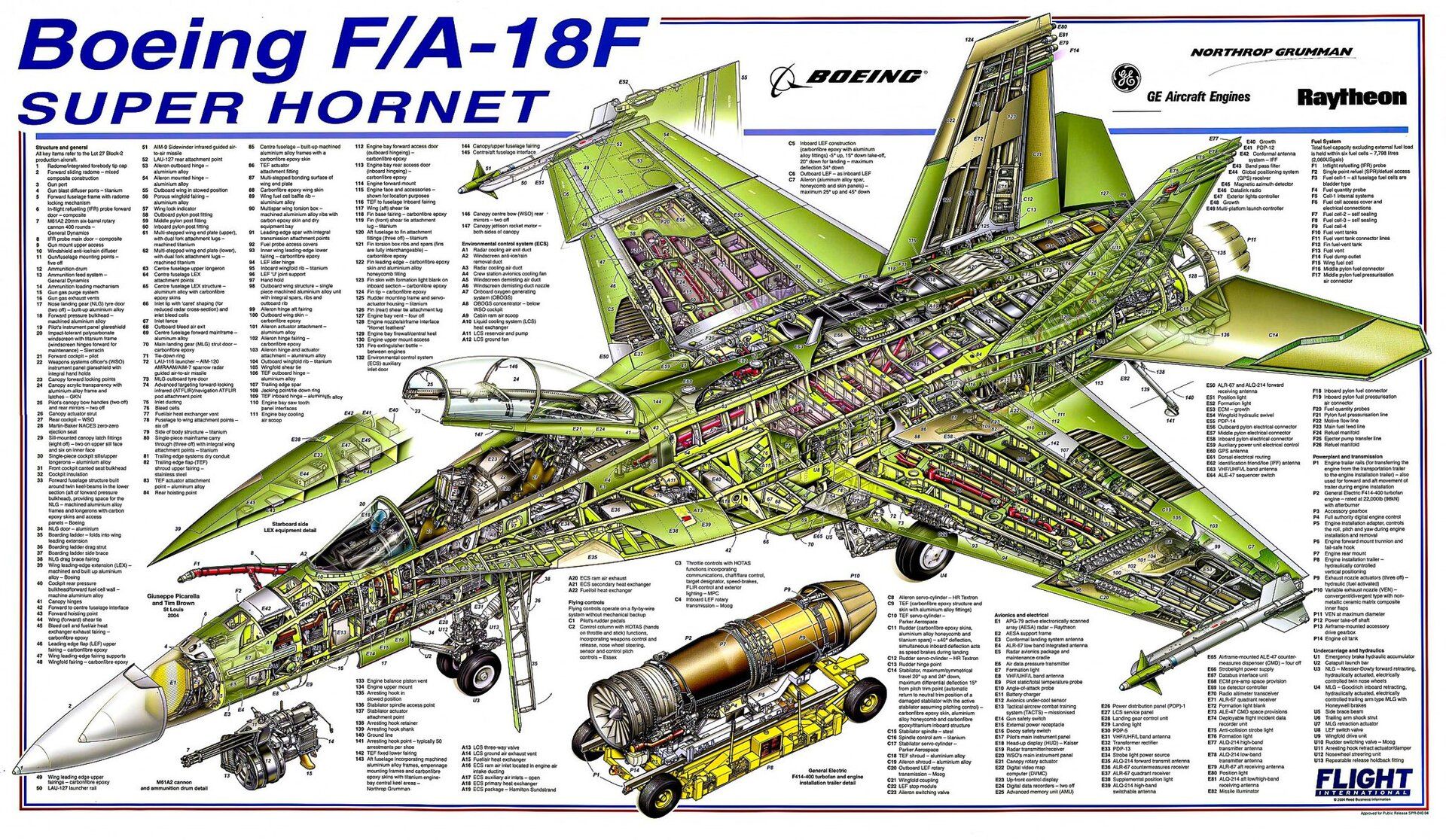

Take the Super Hornet. Boeing’s name is on the hangar, but the aircraft is really a federation of suppliers.

Northrop Grumman shapes the fuselage. GE supplies the F414 engines. Raytheon provides the radar. BAE handles EW systems; L3Harris and Rockwell Collins fill out comms and avionics.

Then there are companies most people have never heard of: The Lee Company, EXAIL, Hypernetics LTD, plus hundreds of small manufacturers producing composites, wiring harnesses, machined parts, and essential hardware without which the airplane would never fly.

I’m not giving the primes a pass; they’ve prioritized shareholder value over warfighter value for too long. But the U.S. defense industrial base isn’t five companies. It’s thousands, stitched together through prime architectures to integrate the ecosystem into something the Pentagon can actually buy.

Which raises an important question as new entrants expand in defense tech: What happens if we burn the legacy architecture before we build something that can actually replace it?

Forterra is designed for this exact gap.

While some young companies position themselves as disruptors operating outside the system, Forterra is wiring autonomy directly into the industrial base that fields hardware at scale.

RTX Ventures (Raytheon) is an investor, and Raytheon partnered with Forterra, Oshkosh, and Ursa Major on an autonomous mobile launcher. BAE Systems and Volvo are also partners, along with Chaos Industries, fresh off a sizable raise.

This is the game the primes understand: ecosystem integration, where technology meets production, certification, logistics, and deployment. It’s also the piece many startups underestimate.

And if the U.S. hopes to maintain deterrence against a nation with more people, more factories, and a willingness to absorb costs we cannot politically or morally match, the answer won’t be out-producing them.

Autonomy gives the U.S. leverage instead of parity. It moves supplies without risking drivers, keeps convoys dispersed, and reduces manning requirements the all-volunteer force can no longer fill.

And the only way to field that capability at scale is through the industrial base we already have.

Challenges

Program Budget Volatility – Forterra remains vulnerable to Congressional appropriations cycles, continuing resolutions, and shifting Pentagon priorities that can delay or reduce contract values regardless of technical performance.

Integration & Compliance Drag – ATO, CMMC, and multi-party integration slow fielding timelines and introduce delays outside Forterra’s control.

Platform Dependency – Relying on OEM partners for production-scale fielding lowers costs but ties Forterra’s growth to the success, timelines, and political fortunes of much larger companies.

Bottom Line:

We’re not going to out-China China. But Forterra shows there’s another path: pair new autonomy with the industrial base that already knows how to build, certify, and field at scale. Innovation doesn’t require rejecting the elders. Sometimes the surest way to scale is to stand on their shoulders.

“Alone a youth runs fast; with an elder, slow — but together they go far.”

Stay Ahead of Defense Innovation

Not just because it’s content

But because the future is being built. And you want a seat at the table.