Editor’s Brief

Last Week we looked at LeVanta Tech and their “Float and Fly” drone.

This week, we spotlight In-Q-Tel, the nonprofit venture arm of the intelligence community that invested in Palantir, Google Earth, and Anduril years before Silicon Valley caught on.

Special thanks to Tyler Fahning for the assist on this weeks article

Our community grows through word of mouth. If you know someone in a program office, venture fund, or government, forward them Defense Tech Signals and get them in the loop.

SIGNAL BRIEF: In-Q-Tel – America’s Original Defense Tech Investor

Origins & Vision

In-Q-Tel (IQT) was founded in 1999 under CIA Director George Tenet after a warning from the Directorate of Science & Technology that government acquisition cycles were falling dangerously behind Silicon Valley’s pace of innovation.

Originally named Peleus, the organization was soon rebranded In-Q-Tel, a nod to “Q,” James Bond’s fictional technology quartermaster. Over time, IQT expanded beyond CIA sponsorship and today, more than a dozen U.S. government entities contribute to its funding. With offices in London, Sydney, Singapore, and Munich, IQT also extends its reach globally.

In-Q-Tel’s mission: “Be the premier partner trusted to identify, evaluate, and leverage emerging commercial technologies for the U.S. national security community and America’s allies.”

Key Takeaways

Force Multiplier: 800+ investments, 500+ technologies transitioned, ~$18 private capital catalyzed per $1 invested.

Global Reach: Offices in London, Sydney, Singapore, and Munich to scout worldwide innovation and strengthen allied coalitions.

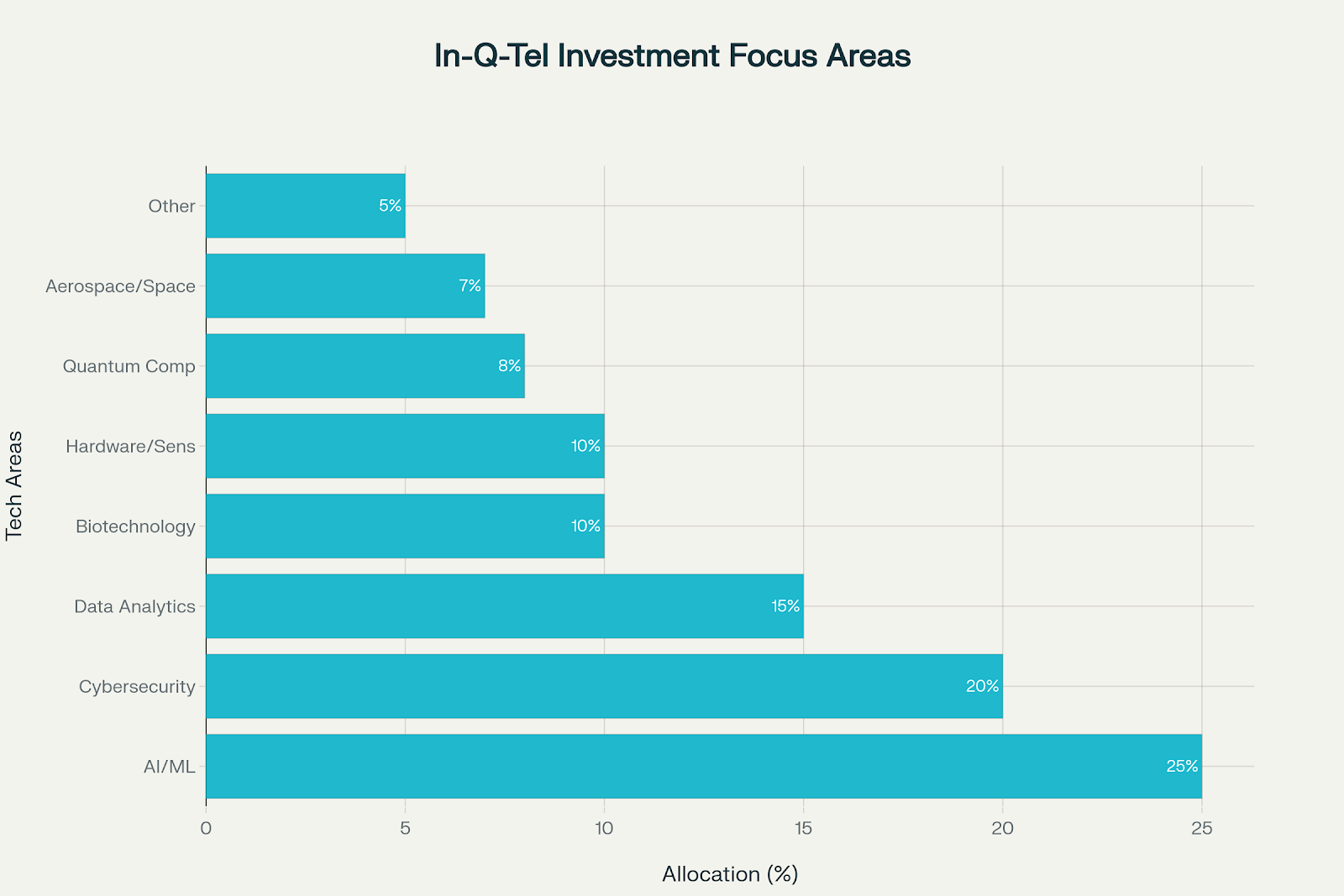

Portfolio Diversification: AI, cybersecurity, space, biotech, microelectronics, and quantum computing, ensuring U.S. advantage across multiple domains.

Not for profit Advantage: Free from pressure to deliver quick financial returns, IQT prioritizes mission adoption and long-term impact over DPI.

Funding Radar:

How the Model Works

IQT is a legally independent, not-for-profit corporation funded through CIA contracts and contributions from partner agencies.

Unlike traditional VCs, IQT has no limited partners seeking profit. Proceeds from exits are mostly reinvested to support new technologies, with only a small portion distributed to employees.

Typical investments are smaller and earlier-stage:

Technology Development Agreements (TDA): $500K–$3M

Equity-only: $250K–$500K

The value lies not in check size, but in validation and proximity to end users.

Investment Radar

Securing the AI Advantage: Moonshine , CLIKA, Neara and GetReal Security (anti-deepfake tools).

Space Infrastructure: Capella Space, Impulse Space, OneNav, Starcloud (secure orbital data centers).

Hardware: Echodyne , Hermeus, Swoop Aero, Vatn Systems

Biosecurity & Life Sciences: Cauldron, Colossal Biosciences, Elegen, Exoflare

Market Signals

Funding & Growth

Total Assets: $998M (2023)

Latest Round: $100–130M from IC budgets

Portfolio Investments: 800+ companies; 500+ transitioned to government use

Capital Leverage: ~$18 private per $1 IQT invests

Notable Investments: Palantir, Keyhole (Google Earth), Anduril, Databricks, MongoDB

Government Partnerships

Intelligence Community – CIA, NSA, NGA, NRO, DIA, FBI

Defense – Space Force, Army DEVCOM, ONR, CENTCOM

Homeland Security – DHS S&T

Allies – UK and Australian intelligence via global office

Looking Ahead

As defense tech has surged over the past year, so too have critiques of how the government invests in tech. Many of the loudest voices are outsiders chasing a trend, the same way crypto was hot in 2021 and AI in 2023.

You don’t need DoD experience to build or fund great technology. In fact, I think top engineers succeed because they approach entrenched problems with fresh eyes.

But there’s a difference between a fund betting on a “cool national security idea” and a fund investing on behalf of the CIA with a direct line to mission need.

One is a market bet. The other is mission validation.

For 25 years, IQT has sat closer to the end user than any other fund, bridging mission requirements with commercial technology. Its record speaks for itself:

-Invested in Palantir years before Silicon Valley grasped its value.

-Google Earth was an intelligence tool before it was a household name.

-And in 2017, IQT quietly backed a startup by the name of Anduril, well before it became the poster child of modern defense tech.

Unlike for-profit VCs, IQT’s nonprofit model lets it take on higher-risk, longer-term bets without the pressure of quick exits. Its metric is adoption and mission impact, not DPI, a distinction that will matter once trend-driven capital dries up.

For investors, IQT on the cap table is a powerful signal: government validation that de-risks the deal and catalyzes follow-on funding. Not every IQT bet succeeds, but when they invest, it’s because the U.S. government has judged the problem real and urgent.

Not just because a founder pitched it well.

Looking ahead, one of the most impactful changes DoD could make is replicating the IQT model for the fight that matters most: the Indo-Pacific. A not-for-profit venture fund dedicated to this theater could directly connect emerging technologies with the operational realities of deterring China.

Starting with $50–75M, the fund could place a handful of strategic bets and reward speed and fieldability over perfection. Anchor funding would come from DoD and DoE budgets, matched by vetted private investors (see trusted capital).

While DIU contracts broadly across defense technology, the Indo-Pacific Fund would invest narrowly with equity-first, mission-tied checks in theater-specific areas.

Rather than operate as a DoD office reliant on appropriated funds and contracting authorities (OTAs, CSOs), it would function as an independent, not-for-profit venture fund with the flexibility to recycle returns and catalyze private capital.

Challenges

Budget Dependence: Vulnerable to political shifts and appropriations battles.

Talent Competition: Recruiting against Silicon Valley compensation.

Integration Friction: Even with IQT, many startups still stall in the government’s “valley of death.”

Bottom Line

In-Q-Tel is strategic national security infrastructure, translating cutting-edge commercial research into battlefield and intelligence capabilities years ahead of traditional acquisition timelines.

Just as IQT has guided the intelligence community for a quarter century, a Pacific-focused fund could validate urgent needs, mobilize commercial capital, and send a clear signal that the U.S. is all-in on the technologies that will define the next conflict.

Stay Ahead of Defense Innovation

Not just because it’s content

But because the future is being built. And you want a seat at the table.